Trust has always been tricky in digital marketing. Building it in a post-AI world only more so.

All the video tips talk about hooking attention ASAFP. But when should you pitch your product?

On that front, short form is becoming long form:

“We’re seeing a trend where some ads are starting to introduce the product much later—like after 40 or even 50 seconds—focusing instead on education upfront. This wasn’t something we saw a year ago,” Chaimovski notes.

via Motion (Education Advantage card)

This is interesting

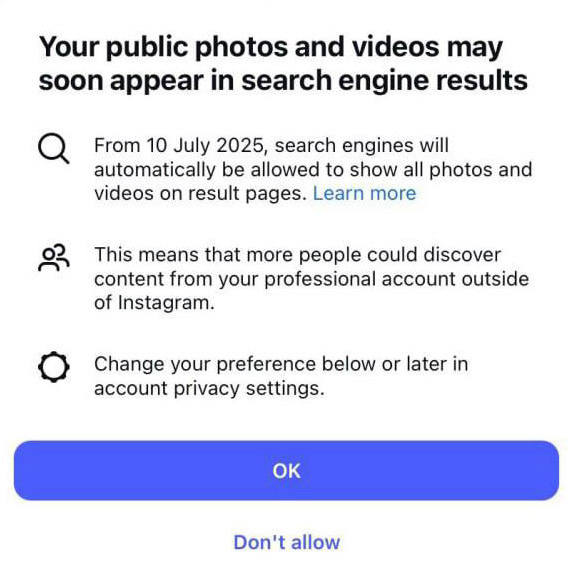

In a recent update, Google has started indexing and sourcing Instagram content.

Now posts and reels function like blog posts from an SEO perspective.

For professional accounts this could mean approaching it more like Pinterest than TikTok.

attached screenshot from IG announcing the update found online

The streaming wars are over, YouTube and Netflix won.

On average, YouTube has an audience of seven million viewers watching off a TV set at any given moment during the day, more than Netflix’s daily average of 4.7 million, Nielsen said.

&

tuned into YouTube on their TV screens at night this year while 10.7 million are watching Netflix, Nielsen said.

Netflix is TV 2.0. YouTube is the second screen home big screen.

From here on staying in business is about financials.

Because it’s still human to human

in the rush to embrace AI tools, it’s easy for marketers to lose sight of what advertising is truly about—building trust, evoking emotion, and connecting with consumers.

AI can help advertisers generate content faster, cheaper, and at a greater scale than before. But volume alone doesn’t make ads remarkable. As Mirella Crespi, founder of the agency Creative Milkshake reminds us, “The goal isn’t just to make ads faster—it’s to make people feel something.”

Accelerate, not replace. Free up your time for your mind.

via Motion (Authenticity Renaissance card)