∞

What’s the core of your brand story that applies across audiences?

What does everyone know you for?

Why do you do what you do?

∞

You can race to the bottom. Or you can race to the top.

One takes hard work.

One has a short runway.

∞

If anyone can make the artifacts of a brand in a trivial amount of time, what distinguishes the ones that last from the ones that fade as quickly as they’re made?

A tweak on a question asked by Manton Reece.

∞

What do you mean when you say “search”?

- News / current events

- Information

- Entertainment

- Local

- Shopping

These are all different intents.

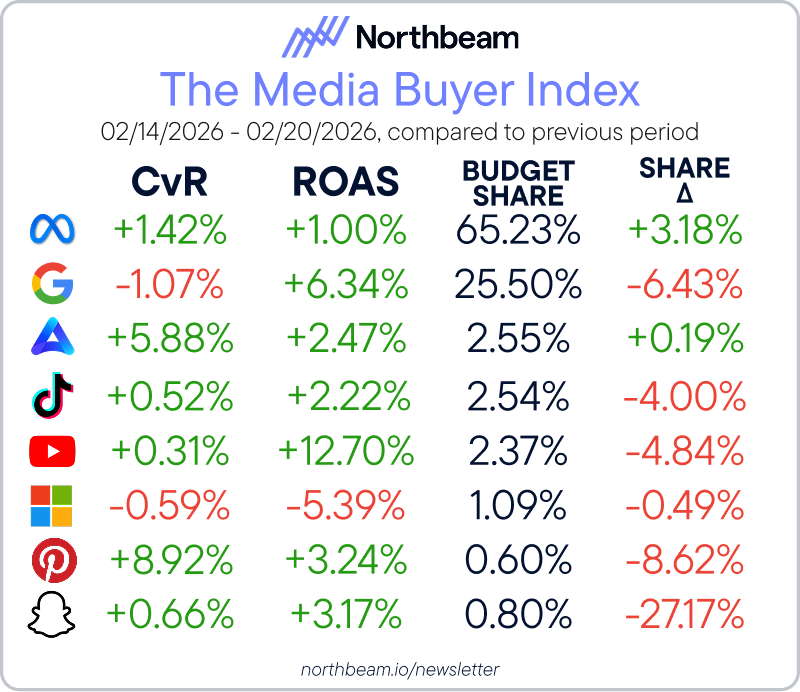

Google used to be the destination for all search types. Now different platforms are carving off different intents.

Search is ( and has been) splintering.