- Search campaign with highest value / most important keywords (exact match)

- AI Max to expand the audience and add incrementality

- PMax / Demand Gen for off-search reach

Running Google Ads? This AI Max for Search post is worth a read.

My read, this is the account structure to use:

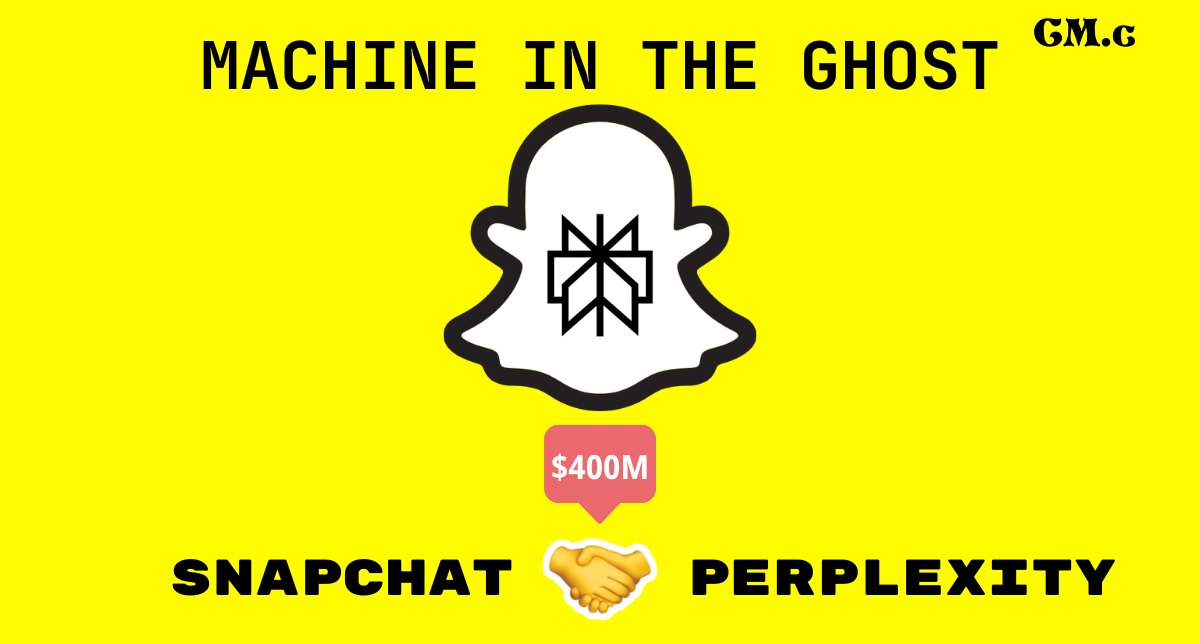

Machine in the Ghost

Perplexity finally found its social network…kind of.

The Google-but-AI search engine inked a deal with Snapchat to be it’s in-app AI answer engine. For the low, low price of $400 million.

Starting in early 2026, Perplexity will appear in the popular Chat interface for Snapchatters around the world. Through this integration, Perplexity’s AI-powered answer engine will let Snapchatters ask questions and get clear, conversational answers drawn from verifiable sources, all within Snapchat.

Perplexity has been following the Google playbook and this is straight from the pay-for-default-status section.

The announcement noted:

Revenue from the partnership is expected to begin contributing in 2026.

I’m interested what the plan is to create that revenue. Snap has the most successful membership option of any social media platform. Will Perplexity Pro be added in?

Will this lay the groundwork for Snapchat Search Ads (a la TikTok)?

Will Perplexity function as a new data source for targeting and get a revenue share?

Similar to My AI, Snapchatter messages sent to Perplexity will help enhance personalization on Snapchat.

On the face of it, it’s a weird fit. But both platforms fill a similar role in their respective industries, not the main characters but also not nameless extras.

Jyll is my go to for Google Ads insight, so this caught my attention:

Too many assets means your ad will take too long to learn and optimize - or never learn at all. 8-10 headlines and 3 descriptions is plenty for most advertisers

Google wants all the robot food, but maybe all is too much.

It makes sense… 🤔

How do you build a brand in world intermediated by chatbots and AI agents?

And in a world that’s less screen-centric?

What about a world with translucent screens we wear on our faces?

How do you become the synonym for the activity? Like Google for search and Kleenex for tissue.

Google ruling LLM 101:

chatbots now routinely incorporate into their responses fresh information from the internet or other sources through a process known as grounding

before, an LLM’s response was time-limited by the end date of its training data…through grounding an LLM can now access content beyond its training data, such as web pages in a search index, to provide more recent and more accurate information

pre-training creates a base (or foundation) model, which is then post-trained (or fine-tuned) on collections of data so that the base model can perform specialized tasks